Explainer (2): Powering the Future: How Data Centres Unlock Malaysia’s Economic Opportunity

In the second article of APDCA’s explainer series, we dive into Malaysia’s fast-growing data centre scene and explore what the surge in data centre investments could mean for Malaysia’s economy. Beyond GDP growth and investment figures, investment in data centre capacity is creating jobs, driving AI and digital innovation, catalysing the clean energy transition and delivering positive impact on local communities in Malaysia.

Learn more about KPMG’s new report commissioned by APDCA, which highlights the economic value that data centres create for Malaysia’s digital economy.

Inside Malaysia’s data centre boom

As Malaysia positions itself as a regional digital hub, data centres are the foundational infrastructure that enables AI, cloud adoption and digital transformation across sectors. They house specialised computing infrastructure that power services in the digital economy and emerging applications for AI and cloud computing (learn more about the fundamentals of data centres in APDCA’s first explainer blog).

Malaysia’s data centre industry is poised for growth. Valued at USD 4 billion in 2024, the market is estimated to grow at an annual rate of 22.4% to reach USD 13.6 billion by 2030.

Malaysia’s Data Centre Market (in USD)

As Malaysia targets digital growth that creates jobs and economic opportunity across the country, ensuring sustainable growth is a key priority. APDCA members are leading efforts to make data centres greener in their energy and water use, pioneering innovations such as efficient cooling methods and the use of AI to optimise cooling or power distribution. APDCA’s forthcoming work will shine a spotlight on best-practice approaches to data centre sustainability.

Strategic infrastructure for Malaysia’s digital economy

The development of new data centre facilities are driving the country’s economic growth. This is detailed in a new KPMG study commissioned by APDCA – the first comprehensive research investigating the economic impact of data centres in Malaysia.

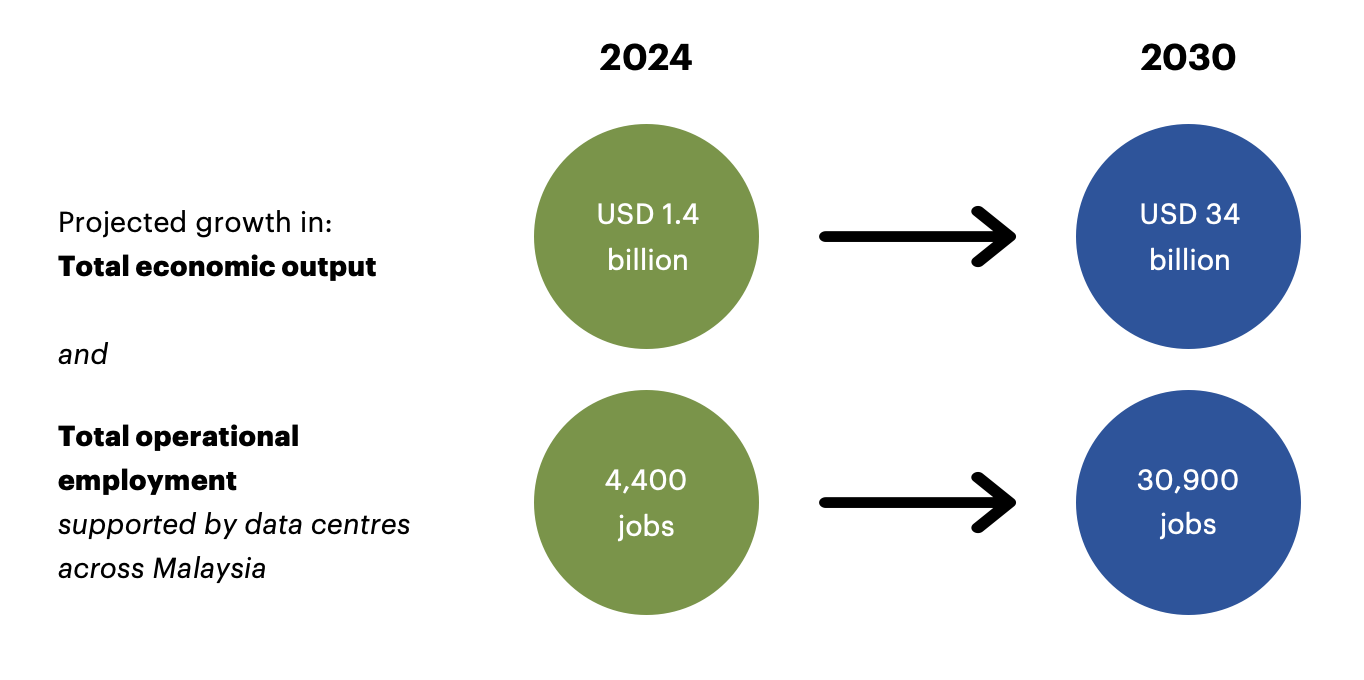

In Malaysia, the data centre sector contributed USD 1.4 billion to total economic output in 2024, supporting over 4,400 jobs across the economy. By 2030, this is forecast to grow to USD 34 billion in economic output and 30,900 jobs.

Source: KPMG report

The report’s authors identified benefits to Malaysia across four critical areas:

Enabling Malaysia’s digital growth;

Supporting activity upstream and growing high-value employment;

Investing in education and training; and

Catalysing investment in energy infrastructure

Enabling Malaysia’s digital growth

Data centres are critical enablers of Malaysia’s ambitions to be a major player in the global digital economy. They provide the infrastructure necessary to power a wide range of services for consumers, businesses and governments, such as online banking, cloud and digital public services.

By providing the digital infrastructure for business operations, data centres are a powerful magnet for foreign direct investment (FDI). They also attract a cluster of digital businesses such as cloud providers, software developers and cybersecurity firms that benefit from proximity to high-speed data processing facilities. This clustering effect contributes to the diversification and growth of the digital economy.

Malaysia’s AI growth – expected to contribute USD 115 billion to the Malaysian economy by 2030 – relies on data centre infrastructure. Data centres provide the essential computing power to train machine learning models, run big data analyses and deliver AI services.

Supporting activity upstream and growing high-value employment

Malaysia’s data centre supply chain is underpinned by a diverse and high-value ecosystem of industries. Data centres support a wide range of upstream activities, from construction to equipment manufacturing, operations and maintenance, professional services, and adjacent manufacturing. They are contributing to the growth of high-paying onshore jobs in three main forms:

Direct employment for skilled roles, such as cloud architects, network engineers, cybersecurity technicians and specialised functions in heating and cooling. The number of direct operational jobs in Malaysian data centres could reach up to 7,300 by 2030.

Indirect employment across their extensive procurement and supply chains, such as civil engineering, construction and utility services.

Induced employment when those directly and indirectly employed spend their income on housing and services including retail and transportation. The KPMG report found a x4.2 multiplier effect for data centre jobs, meaning that for every direct job in a data centre, an additional 3.2 jobs are supported in other Malaysian industries.

Source: KPMG report

Investing in education and training

Data centres can play a role in addressing the growing demand for skilled workers in the ICT sector, particularly in Malaysia, where the industry faces a shortage of qualified professionals due in part to gaps in education and training. By investing in local talent development, through partnerships with educational institutions, apprenticeships, and support for STEM programmes, data centre operators help bridge this skills gap.

As one example, Princeton Digital Group, an APDCA member, has joined forces with the University of Malaya and University of Technology Malaysia (UTM) to roll out its Graduate Engineer Trainees (GET) programme.

In turn, local communities in Malaysia stand to benefit from better job prospects and wage growth. From 2024 to 2030, the total annual wage income supported by data centres is projected to rise eightfold and reach USD 1.3 billion in 2030.

Catalysing energy infrastructure investment

Data centres are driving investment in energy and connectivity infrastructure. Investment in energy infrastructure – the building of smart grids and expansion of grid capacity – benefits Malaysian households and firms by improving energy resilience and reducing power outages.

Data centre operators are also driving Malaysia’s transition to renewable energy sources. Operators are partnering with utilities, independent power producers, and governments to procure renewable energy, aligning with Malaysia’s green growth ambitions.

Much of Malaysia’s data centre capacity is concentrated in Johor and the Klang Valley. Johor supplies 79% of the country’s data centre capacity. It boasts one of Asia-Pacific’s lowest colocation vacancy rates – at 1%.

According to Knight Frank’s report, Johor’s data centre sector is positioned for significant expansion with 85% capacity growth (335 MW) over the next two years, supporting by USD$4.7 billion in investment.

Data centre investments are driving economic benefits in Johor. In 2024, Johor led all Malaysian states in GDP growth, fuelled by the burgeoning investment into the data centre sector. Continued investment could unlock further employment opportunities for Johor communities. To capitalise, the Johor Talent Development Council has launched its inaugural Data Centre Technician Programme to further develop specialised skills in the sector.

Looking ahead

With the right policy environment, the Malaysian government can encourage sustainable growth of data centres, generating local employment and economic impact across the value chain.

KPMG’s research has focused on four priority areas:

APDCA looks forward to maintaining dialogue with the government and wider stakeholders to promote policies that foster a sustainable and competitive data centre industry in Malaysia.